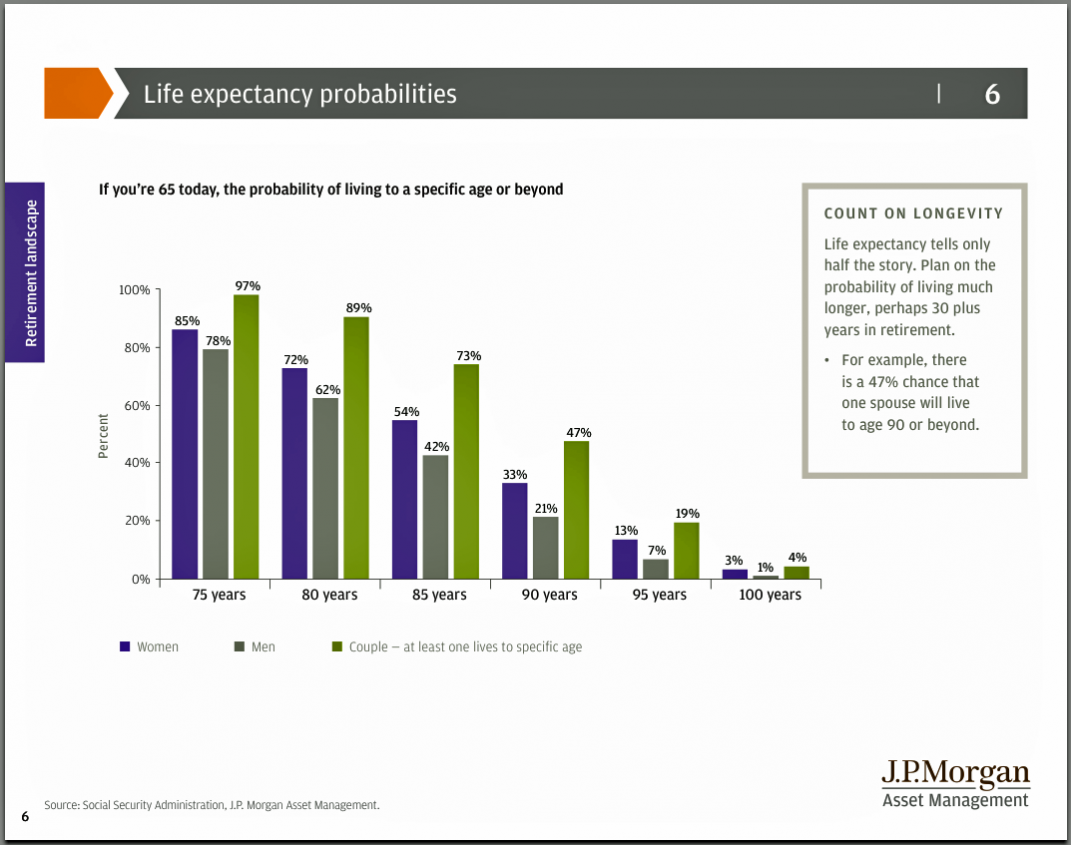

Table #1

Starting out this discussion with lifespan projections is already a bummer, but don’t worry. It gets worse.

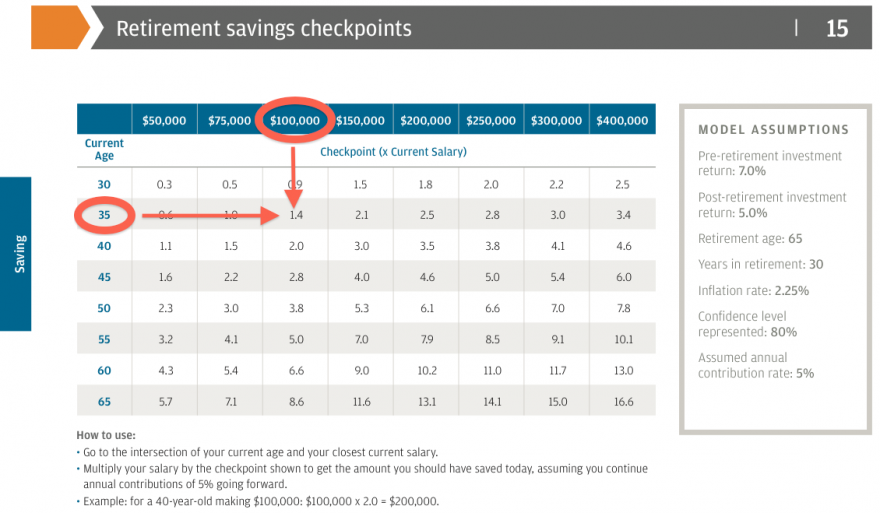

Table #2

If you’re a Baby Boomer [51-68 yrs of age] making 300k/yr, a 60-year-old will need approximately 11.7 times that amount properly invested in order to realize the same income – and that’s assuming market conditions are stable. They’re not.

So let’s get real.

As I state in my book, “Urban Dystrophy,” on Amazon, a starter portfolio starts at around $5,000,000.

The reason I say this is because most guys I know like to do things like date beautiful women [or men], travel, dine out, and buy cool shit – all of which cost money. Lots of it.

None of this is a problem if your day job is bringing in 300k and your retirement money is – for the most part – rolled back into your portfolio.

But what if there is no day job and you’re living off of passive income alone [investments]?

Now the numbers have to change drastically, because in order to earn 300k on a 3.5 mil portfolio, you’ll have to be either an investment genius or selling crack on the side.

In my world [i.e., urban, educated, worldly, sophisticated – probably entitled], you’ll need approximately $7.5 mil to live a very nice – but not extravagant – lifestyle without having to worry about spending it all.

~~~

$7.5 million dollars is a lot of money.

Most guys making $600k/year for 25 years don’t have anywhere close to that amount invested.

Hell, most guys making a 1 million a year for 25 years don’t have that amount in savings.

How is this possible?

Easy.

On a 1 million dollar a year salary, you walk home with approximately $600k, or $50k/month, net-net.

If you own a $2 million dollar home, which is considered normal in these circles, you’re paying $50-$60k in annual property taxes alone on a 30-year house note of $1.5 million [after a 500k down payment], which lands you in the $10k/month range – excluding everything that goes into running a house, like utilities, repairs, and so on.

Add a second home somewhere in the mountains [a small place], a wife, two kids in private schools, and a couple of exotic vacations a year and you have about 150k left to invest, if you’re disciplined.

At the end of 25 years, you will have saved approximately $3,750,000 plus whatever your portfolio has generated over that time period, which most people place at about 8% /year [on good years].

Weird, huh?

And you thought everyone had at least $20 mil in the bank.

~~~

With $7.5 million well invested, you can comfortably take out 500k/yr, enough to live a great life without worries.

This doesn’t mean you can run out an buy yachts, travel in private jets, or buy a big place in Aspen.

But you can own a $2 mil home, put two cars in the driveway, shop at Whole Foods, and stay in 5-star hotel properties suites accompanied by reasonably well-equipped gold-diggers who might also love you for who you are, though most gold-diggers with the capacity to feel actual human emotions usually start in the $10 mil range.